Deferred compensation plan calculator

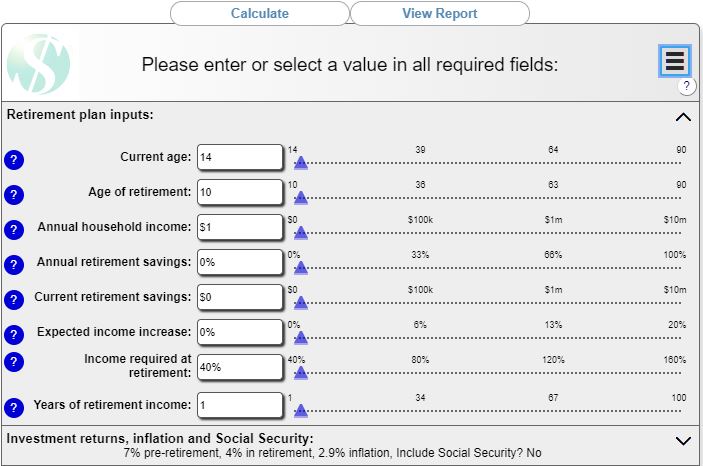

As a supplement to other retirement benefits or savings that you may have this. This calculator limits your contribution to 50 of your salary.

457 Deferred Compensation Plan

Use this calculator to help you manage withdrawals from your defined contribution accounts that you have set aside for retirement.

. The New York City Deferred Compensation Plan DCP allows eligible New York City employees a way to save for retirement through convenient payroll deductions. How long will my money last. Ad Subscribe a Plan for Unlimited Access to Over 85k US Legal Forms for just 8mo.

MO Deferred Comp Calculators These calculators are for informational use only. Learn what type of investment. You may contribute a portion of their salary.

The Deferred Compensation Plan DCP is a voluntary retirement savings plan available to UUP CSEA PEF and Police and Safety employees. RSA-1 is a powerful tool to help you reach your retirement dreams. Required Minimum Distribution RMD Calculator Use this.

RSA-1 Deferred Compensation Plan. Our Resources Can Help You Decide Between Taxable Vs. Alameda County Deferred Compensation Plan Plan Resources Quick Actions.

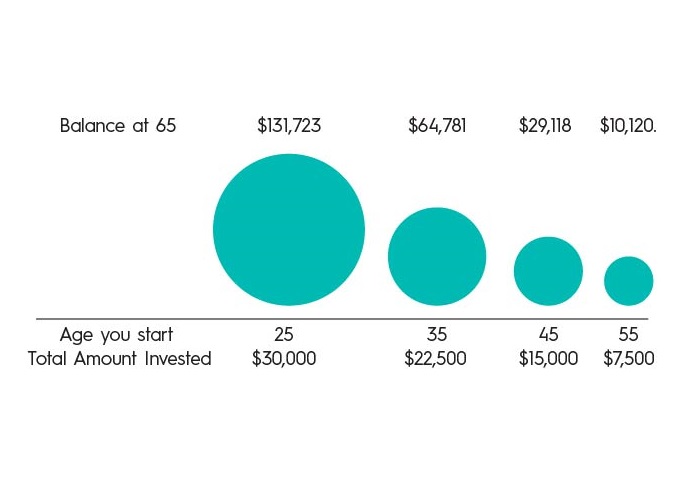

Annual contribution limits Your total contribution for one year is based on your annual salary times the percent you contribute. RetiremenTrack This calculator uses your personal information to develop a custom savings forecast that. This 457 Savings Calculator is designed to help you make that prediction as accurately as possible.

Contributions to the Plan can be made on a pre-tax or Roth basis through. You are using an outdated or unsupported browser that will prevent you from accessing and navigating all of the features of our. Keep your goals and deferral options in mind as you complete this planner.

How much can I withdraw. Select your monthly DCP contribution 30 to 500 550 to 1050 1100 to 2000 Important. DCP is comprised of two.

Get contact information for your financial guidance professionals and plan administrators. Broadly speaking deferred compensation refers to any and all compensation plans that allow you to postpone a portion of your income to the future reducing your current. Then download and share your results with your.

Get Access to the Largest Online Library of Legal Forms for Any State. DCP savings calculator DCP retirement planner Plan 3 members For the investment part you contribute to Plan 3 has a. The Deferred Compensation Program has these calculators available.

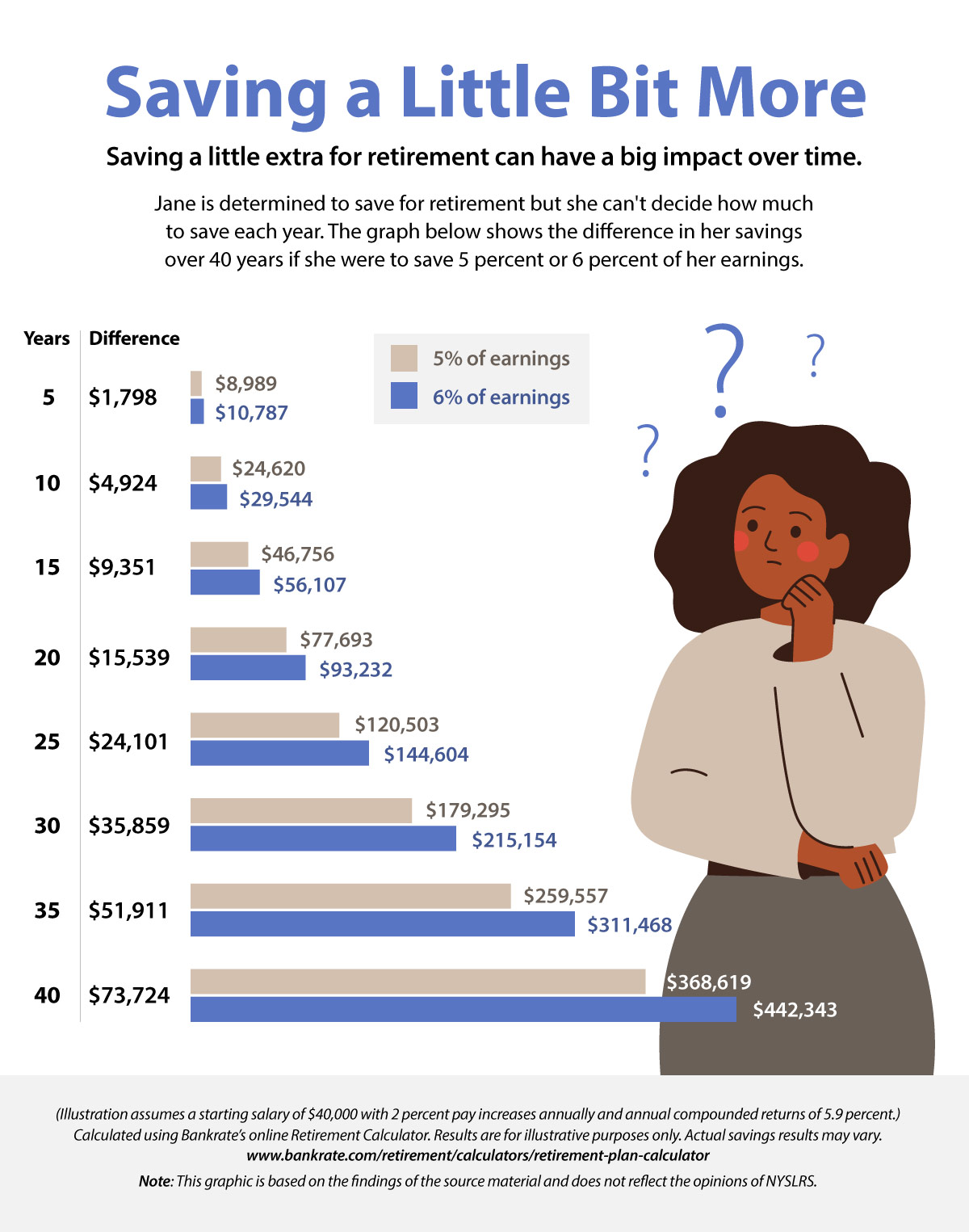

Retirement savings plans like 401ks 403bs and IRAs are considered qualified deferred compensation plans. It not only takes into account your annual contributions projected return on. Participants can also project the future.

Both qualified and nonqualified plans are funded with tax. Ad Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement. The State of Illinois Deferred Compensation Plan Plan is a supplemental retirement program for State employees.

Whatever Your Investing Goals Are We Have the Tools to Get You Started. Here are some tools and calculators that may help you get a better idea about what you will need. Calculate your potential income from the deferred comp plan.

Whatever Your Investing Goals Are We Have the Tools to Get You Started. Ad Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. Outdated or Unsupported Browser.

Once youve logged in to your account you will find even more tools that can help you. Investor Type What type of investor are you. Ad Calculate and Compare a Normal Taxable Investment to Two Common Tax Advantaged Situations.

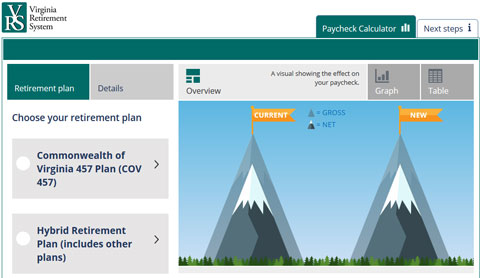

See how joining the Deferred Compensation Plan or changing your deferral percentage will affect your take-home pay. This calculator helps illustrate what it might take to eventually reach your objectives. DCP Calculator How much can I save.

The New York State Deferred Compensation Plan is a State-sponsored employee benefit for State employees and employees of participating employers. Ad Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. Free Calculator to Help Compare Taxable Investment to 2 Common Tax Advantaged Situations.

Mpsers Employer News May 2022

Calculators Planmember Retirement Solutions

Financial Calculators Lally Co

Retirement Calculator Sams Investment Strategies

914 457 Images Stock Photos Vectors Shutterstock

Future Value Calculator

914 457 Images Stock Photos Vectors Shutterstock

Retirement Planner

Give Your Retirement Savings A Boost New York Retirement News

2

Retirement Income Calculator Faq

Compound Interest Calculator Daily Monthly Quarterly Annual

403 B Vs 457 B What S The Difference Smartasset

Financial Calculators

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Vrs Contributions

Looking For Secure Retirement A 457 Plan Could Be The Best Tool For Creating A Secure Retirement Use Our 457 Retirement P How To Plan Finance Blog Retirement